Why Your House Didn’t Sell

If your listing expired and your house didn’t sell, you’re likely feeling a little frustrated. Not to mention, you’re also probably wondering what went wrong. Here are three questions to think about as you figure out what to do next.

Did You Limit Access to Your House?

One of the biggest mistakes you can make when selling your house is restricting the days and times when potential buyers can tour it. Being flexible with your schedule is important when you’re selling your house, even though it might feel a bit stressful to drop everything and leave when buyers want to see it. After all, minimal access means minimal exposure to buyers. ShowingTime advises:

“. . . do your best to be as flexible as possible when granting access to your house for showings.”

Sometimes, the most determined buyers might come from far away. Since they’re traveling to see your house, they may not be able to change their plans easily if you only offer limited times for showings. So, try to make your house available as much as you can to accommodate them. It’s simple. If no one’s able to look at it, how’s it going to sell?

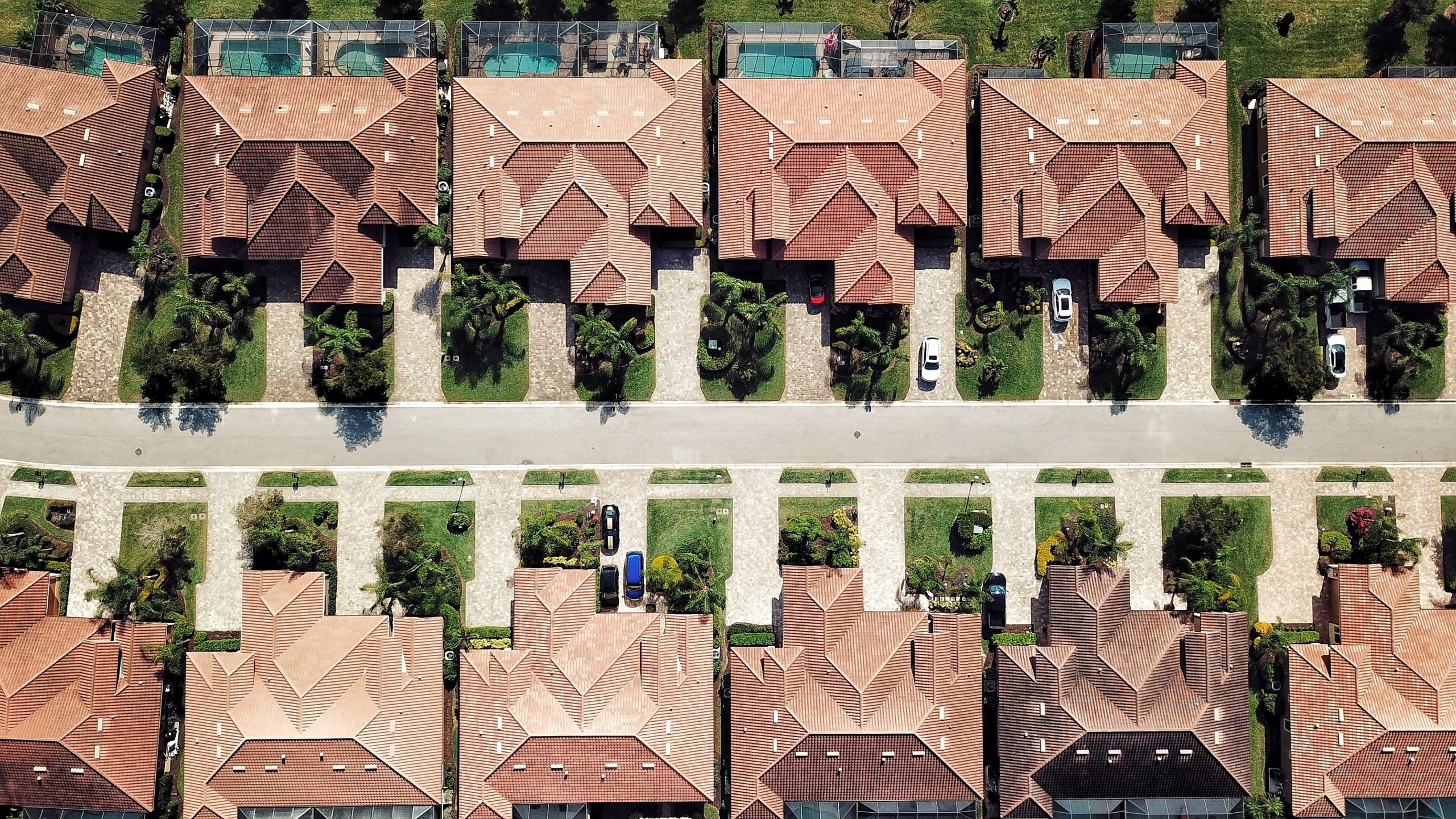

Did You Make Your House Stand Out?

When selling your house, the old saying matters: you never get a second chance to make a first impression. Putting in the work to make the exterior of your home look nice is just as important as how you stage it inside. Freshen up your landscaping to improve your home’s curb appeal so you can make an impact upfront. As an article from U.S. News says:

“After all, if people drive by, but aren’t interested enough to walk through the front door, you’ll never sell your house.”

But don’t let that impact stop at the front door. By removing personal items and reducing clutter inside, you give buyers more freedom to picture themselves in the home. Additionally, a new coat of paint or cleaning the floors can go a long way to freshening up a room.

Did You Price Your House Compellingly?

Setting the right price is extremely important when you’re selling your house. Even though it might feel tempting to push the price higher to maximize your profit, overpricing can scare away buyers and make it hard to sell quickly. Business Insider notes:

“. . . the biggest mistake sellers make is overpricing their home.”

If your house is priced higher than others like it, it could make buyers lose interest. Pay attention to the feedback people give your agent during open houses and showings. If lots of people are saying the same thing, it might be a good idea to think about lowering the price.

For all these insights and more, rely on a trusted real estate agent. A great agent will offer expert advice on relisting your house with effective strategies to get it sold.

Bottom Line

It’s natural to feel disappointed when your listing has expired and your house didn’t sell. Let’s connect to figure out what happened and what to reconsider or change if you want to get your house back on the market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link